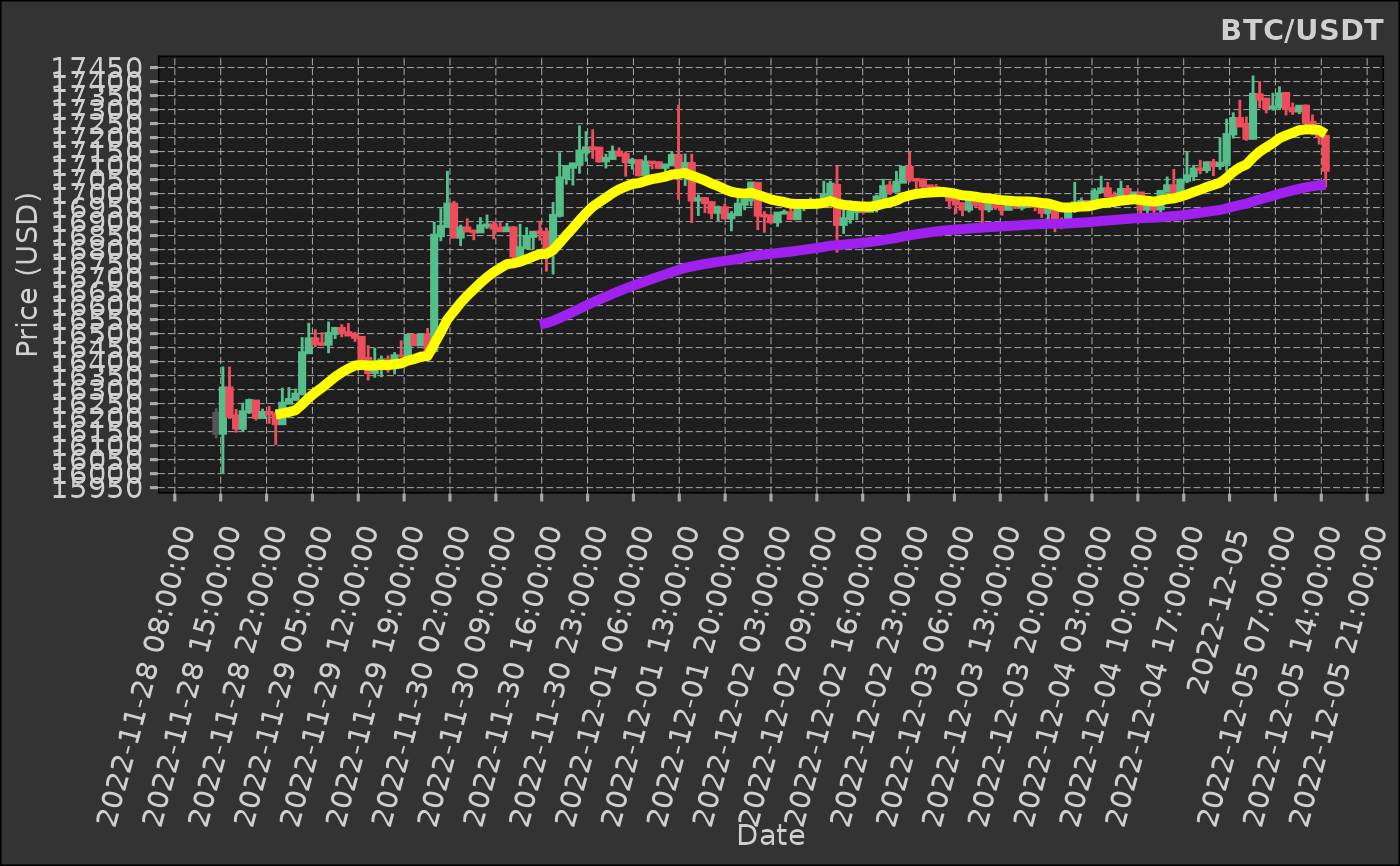

`stat_movingaverages` is a `ggplot2` layer that allows you to plot moving averages on a `ggplot2` plot either by providing the column names `ggplot2::aes` of the previously calculated metrics.

You are free to use whatever algorithm you desire; the result will be two line plots one for a short moving average and one for a long moving average.

To use this layer provide `ggplot2::aes` values for `x` (datetime x-axis) and `short` and `long` (y-axis).

See examples for more details.

Usage

stat_movingaverages(

mapping = NULL,

data = NULL,

geom = "line",

position = "identity",

na.rm = TRUE,

show.legend = NA,

inherit.aes = TRUE,

linewidth = 1.75,

alpha = 0.75,

colour = list(short = "yellow", long = "purple"),

...

)Arguments

- mapping

A `ggplot2::aes` object (required - default `NULL`).

- data

A `data.table` object (required - default `NULL`).

- linewidth

A `numeric` vector of length one; the width of the line (optional - default `1.75`).

- alpha

A `numeric` vector of length one; the alpha of the line (optional - default `0.75`).

- colour

A named or unnamed `list` with three elements "short" and "long". These are the colours for the short and long moving averages (optional - default `list(short = "red", long = "blue")`).

Details

This is a `ggplot2` extension; it is used with the `+` operator for adding a layer to a `ggplot2` object.

Aesthetics

stat_movingaverages understands the following aesthetics (required aesthetics are in bold):

x -- datetime (x-axis)

short -- the values for the short moving average (y-axis).

long -- the values for the long moving average (y-axis)

Examples

# get some financial data

# kucoin is private package - you can use any data source

ticker <- "BTC/USDT"

dt <- kucoin::get_market_data(

symbols = ticker,

from = "2022-11-28 15:29:43 EST", # lubridate::now() - lubridate::days(7),

to = "2022-12-05 15:29:31 EST", # lubridate::now(),

frequency = "1 hour"

)

dt

#> symbol datetime open high low close volume

#> <char> <POSc> <num> <num> <num> <num> <num>

#> 1: BTC/USDT 2022-11-28 15:00:00 16215.3 16233.6 16126.0 16144.1 327.8979

#> 2: BTC/USDT 2022-11-28 16:00:00 16144.1 16382.6 16000.0 16305.9 837.5801

#> 3: BTC/USDT 2022-11-28 17:00:00 16305.9 16382.0 16195.4 16205.4 507.8351

#> 4: BTC/USDT 2022-11-28 18:00:00 16206.1 16230.7 16146.5 16162.6 252.3387

#> 5: BTC/USDT 2022-11-28 19:00:00 16161.7 16253.3 16150.1 16220.9 225.4121

#> ---

#> 165: BTC/USDT 2022-12-05 11:00:00 17295.2 17314.3 17283.8 17312.0 176.8633

#> 166: BTC/USDT 2022-12-05 12:00:00 17312.0 17318.6 17230.5 17254.5 199.6922

#> 167: BTC/USDT 2022-12-05 13:00:00 17254.5 17282.5 17208.1 17229.7 105.2655

#> 168: BTC/USDT 2022-12-05 14:00:00 17229.8 17241.4 17175.1 17205.2 140.4375

#> 169: BTC/USDT 2022-12-05 15:00:00 17205.1 17205.1 17021.6 17083.0 504.9158

#> turnover

#> <num>

#> 1: 5301836

#> 2: 13557348

#> 3: 8270203

#> 4: 4082464

#> 5: 3653147

#> ---

#> 165: 3058929

#> 166: 3447960

#> 167: 1815447

#> 168: 2416907

#> 169: 8630174

# we need a function that calculates the indicator for us

# typically I like to write my own functions in C++; in this case we will use TTR's

# the stat expects a named list to be returned - we redefine ttr

ema <- function(close, n = 2, wilder = TRUE) {

return(as.list(as.data.frame(TTR::EMA(close, n = n, wilder = wilder))))

}

# calculate the short and long moving averages

dt[, ema_short := ema(close, n = 10, wilder = TRUE)]

#> symbol datetime open high low close volume

#> <char> <POSc> <num> <num> <num> <num> <num>

#> 1: BTC/USDT 2022-11-28 15:00:00 16215.3 16233.6 16126.0 16144.1 327.8979

#> 2: BTC/USDT 2022-11-28 16:00:00 16144.1 16382.6 16000.0 16305.9 837.5801

#> 3: BTC/USDT 2022-11-28 17:00:00 16305.9 16382.0 16195.4 16205.4 507.8351

#> 4: BTC/USDT 2022-11-28 18:00:00 16206.1 16230.7 16146.5 16162.6 252.3387

#> 5: BTC/USDT 2022-11-28 19:00:00 16161.7 16253.3 16150.1 16220.9 225.4121

#> ---

#> 165: BTC/USDT 2022-12-05 11:00:00 17295.2 17314.3 17283.8 17312.0 176.8633

#> 166: BTC/USDT 2022-12-05 12:00:00 17312.0 17318.6 17230.5 17254.5 199.6922

#> 167: BTC/USDT 2022-12-05 13:00:00 17254.5 17282.5 17208.1 17229.7 105.2655

#> 168: BTC/USDT 2022-12-05 14:00:00 17229.8 17241.4 17175.1 17205.2 140.4375

#> 169: BTC/USDT 2022-12-05 15:00:00 17205.1 17205.1 17021.6 17083.0 504.9158

#> turnover ema_short

#> <num> <num>

#> 1: 5301836 NA

#> 2: 13557348 NA

#> 3: 8270203 NA

#> 4: 4082464 NA

#> 5: 3653147 NA

#> ---

#> 165: 3058929 17226.35

#> 166: 3447960 17229.17

#> 167: 1815447 17229.22

#> 168: 2416907 17226.82

#> 169: 8630174 17212.44

dt[, ema_long := ema(close, n = 50, wilder = TRUE)]

#> symbol datetime open high low close volume

#> <char> <POSc> <num> <num> <num> <num> <num>

#> 1: BTC/USDT 2022-11-28 15:00:00 16215.3 16233.6 16126.0 16144.1 327.8979

#> 2: BTC/USDT 2022-11-28 16:00:00 16144.1 16382.6 16000.0 16305.9 837.5801

#> 3: BTC/USDT 2022-11-28 17:00:00 16305.9 16382.0 16195.4 16205.4 507.8351

#> 4: BTC/USDT 2022-11-28 18:00:00 16206.1 16230.7 16146.5 16162.6 252.3387

#> 5: BTC/USDT 2022-11-28 19:00:00 16161.7 16253.3 16150.1 16220.9 225.4121

#> ---

#> 165: BTC/USDT 2022-12-05 11:00:00 17295.2 17314.3 17283.8 17312.0 176.8633

#> 166: BTC/USDT 2022-12-05 12:00:00 17312.0 17318.6 17230.5 17254.5 199.6922

#> 167: BTC/USDT 2022-12-05 13:00:00 17254.5 17282.5 17208.1 17229.7 105.2655

#> 168: BTC/USDT 2022-12-05 14:00:00 17229.8 17241.4 17175.1 17205.2 140.4375

#> 169: BTC/USDT 2022-12-05 15:00:00 17205.1 17205.1 17021.6 17083.0 504.9158

#> turnover ema_short ema_long

#> <num> <num> <num>

#> 1: 5301836 NA NA

#> 2: 13557348 NA NA

#> 3: 8270203 NA NA

#> 4: 4082464 NA NA

#> 5: 3653147 NA NA

#> ---

#> 165: 3058929 17226.35 17017.34

#> 166: 3447960 17229.17 17022.08

#> 167: 1815447 17229.22 17026.23

#> 168: 2416907 17226.82 17029.81

#> 169: 8630174 17212.44 17030.88

dt |>

ggplot2::ggplot(ggplot2::aes(

x = datetime,

open = open,

close = close,

high = high,

low = low,

group = symbol

)) +

## ------------------------------------

dmplot::stat_candlestick() +

## ------------------------------------

# provide the colnames to the calculated indicators as aes values

dmplot::stat_movingaverages(ggplot2::aes(short = ema_short, long = ema_long), alpha = list(mavg = 0.5)) +

## ------------------------------------

ggplot2::scale_x_continuous(n.breaks = 25, labels = \(x) {

lubridate::floor_date(lubridate::as_datetime(x), "hours")

}) +

ggplot2::scale_y_continuous(n.breaks = 25) +

ggplot2::labs(

title = ticker,

x = "Date",

y = "Price (USD)"

) +

dmplot::theme_dereck_dark() +

ggplot2::theme(

axis.text.x = ggplot2::element_text(angle = 75, vjust = 0.925, hjust = 0.975),

panel.grid.minor = ggplot2::element_blank()

)